Paychex payroll calculator

As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. Using eSmartPaycheck you can prepare paychecks calculate federal and state taxes print checks and pay stubs and print 941 and W2 forms for free.

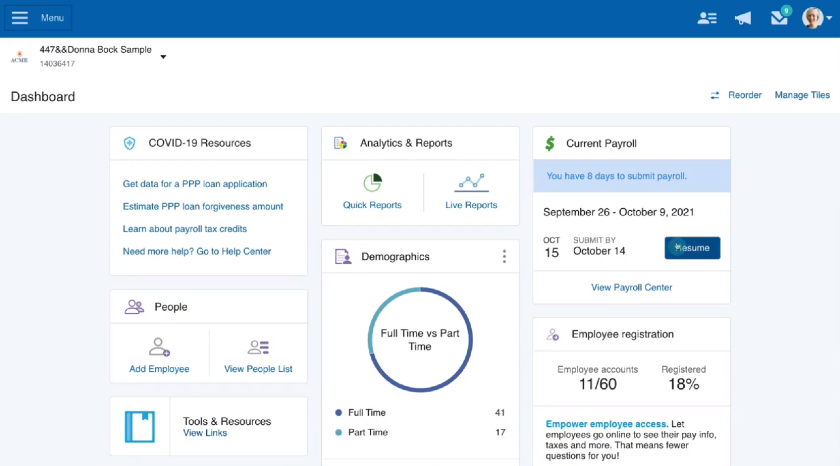

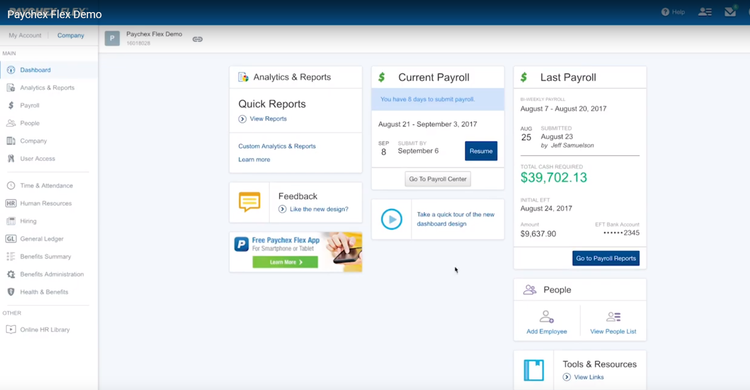

Paychex Flex Demos Paychex

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

. 2Enter the Hourly rate without the dollar sign. Outsource payroll to a service. State Unemployment Insurance Calculator.

Use an online stand-alone payroll accounting application like Gusto or Paychex. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions. With online time and attendance software offered by Paychex your business regardless of size or industry can improve payroll accuracy.

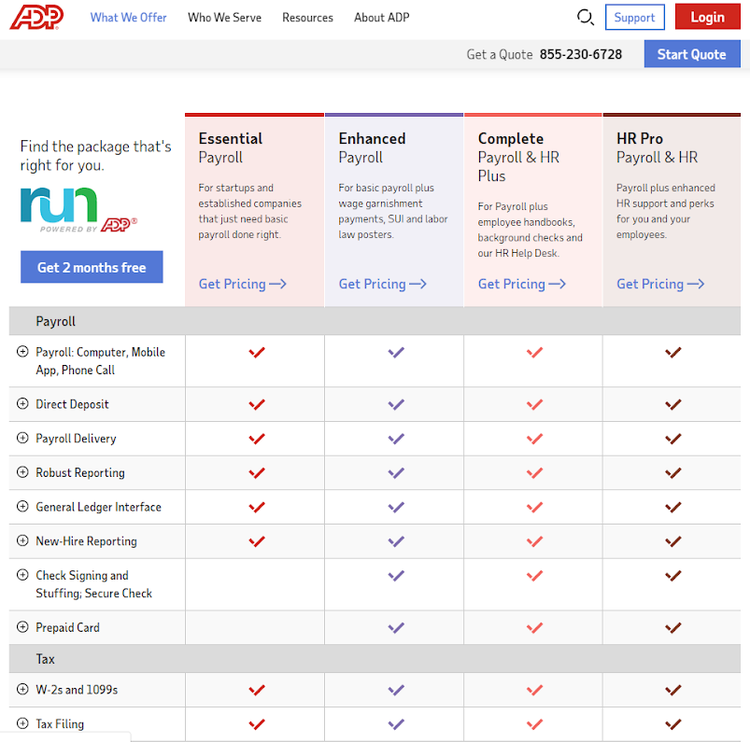

The PE ratio of Paychex is 3148 which means that it is trading at a less expensive PE ratio than the market average PE ratio of about 11281. Essentials Enhanced Complete and HR Pro. Your accountant may be able to provide this service or you can find a person or company that will personally handle your companys payrollcreating paychecks and putting money into a dedicated account.

Explore how the payroll calculators can help make taxes a breeze and employee wages a no-brainer. Payroll Calculators will quickly calculate deductions taxes and pay for your paychecks. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

Employees in California have multiple options when it comes to saving for retirement. There are four small business solutions in the ADP Run line. Multiple Pay Frequencies Payroll Cycle Duration.

You can save on federal state and local taxes for many medical and dependent care expenses when you put pre-tax dollars into your flexible spending account FSAIn fact FSA participants save an average of up to 40 percent each year on many out-of-pocket expenses. Earnings for Paychex are expected to grow by 749 in the coming year from 414 to 445 per share. There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance.

Price to Earnings Ratio vs. Learn more about 401k options opportunities to save with the state. Our easy to use state unemployment insurance SUI calculator provides your annual potential SUI savings with just a few metrics about your employees.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. ADVANTAGES OF OUTSOURCING PAYROLL PROCESSING. Payroll steps from the US.

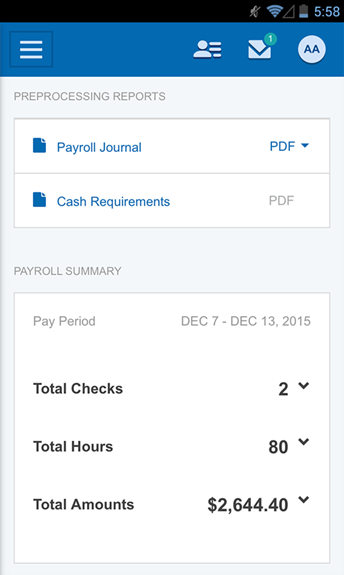

The Paychex Flex app has 48 stars out of five on Apples App Store and 41 on Google Play. Important note on the salary paycheck calculator. With this WOTC calculator Paychex can help you determine your potential savings.

Fast easy accurate payroll and tax so you save time and money. Paychex employees rate the. If your payroll provider isnt in the list above please.

Rippling syncs all your businesss HR data with payroll so you never have to use a calculator or manually enter data like hours and deductions. But instead of integrating that into a general. Before You Get Started.

The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. Allow pop-ups to be able to print the Hour Calculator. Use the Right Arrow or Left Arrow to choose between AM and PM.

Most payroll providers charge a small monthly fee ranging from 20 to 100 per month plus a per-employee payroll feeoften less than 10 per employee per pay period. Stella Morrison contributed to the writing and research in this article. With free employee scheduling time clocks and timesheets plus payroll team communication hiring onboarding and labor law compliance managers and employees can spend less time on paperwork and more time on growing their business.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial data. Of the five or so that do Paychexs is easily the best. Gain back lost time spent on entering or importing time cards and help ensure youre paying employees for time actually worked with an online time and attendance system integrated with payroll.

Paychex Retirement Calculator Information. Please note that eligible expenses will be reimbursed in full up to 2850 for medical expenses. Along with a 401k if employers offer such a retirement program through company benefits there is also a state-sponsored retirement program that has begun rolling out over the past few years.

Price to Earnings Ratio vs. Benefits of Using a Payroll Calculator. Only a few payroll providers offer employer-facing mobile payroll apps.

3Email it or print it. Payroll Tax Calculator TimeTrex uses an advanced payroll calculation engine that will automatically calculate federal state and local income taxes as well as other custom deductions such as benefits insurance garnishments and vacation sick leave accruals. Run payroll in 90 seconds.

Our software comes with a built-in payroll and paycheck calculator for federal withholding and state withholding for all 50 states and District of Columbia. Paychex Inc a leading provider of integrated human capital management software solutions for human resources payroll benefits and insurance services has been recognized as one of the top training organizations in the world with a 2022 Training APEX. Maintaining an active approach to State Unemployment Insurance SUI tax rates can help ensure you are not only compliant but not spending more than you must.

The average Paychex salary ranges from approximately 59410 per year for a Call Center Representative to 207887 per year for a Software Engineering Manager. IRS withholding calculator. There are steps you can take to appraise your premiums including using this simple SUI calculator to determine potential savings.

For entering information using the 24 hour clock see our Time Card Calculator with Military Time. All you need to do is click Run Its that easy. The average Paychex hourly pay ranges from approximately 28 per hour for a Call Center Representative to 76 per hour for a Human Resources Business Partner.

These calculators are not intended to provide tax or legal advice and do not represent any ADP. The Work Opportunity Tax Credit WOTC has been extended through 2020. Tax tables and payroll formulas are updated throughout the year and pushed via the touch-free auto-update mechanism.

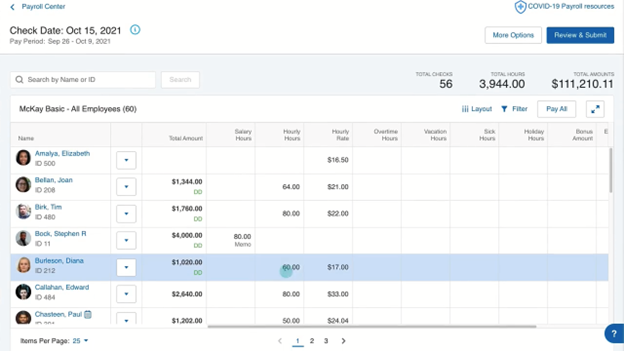

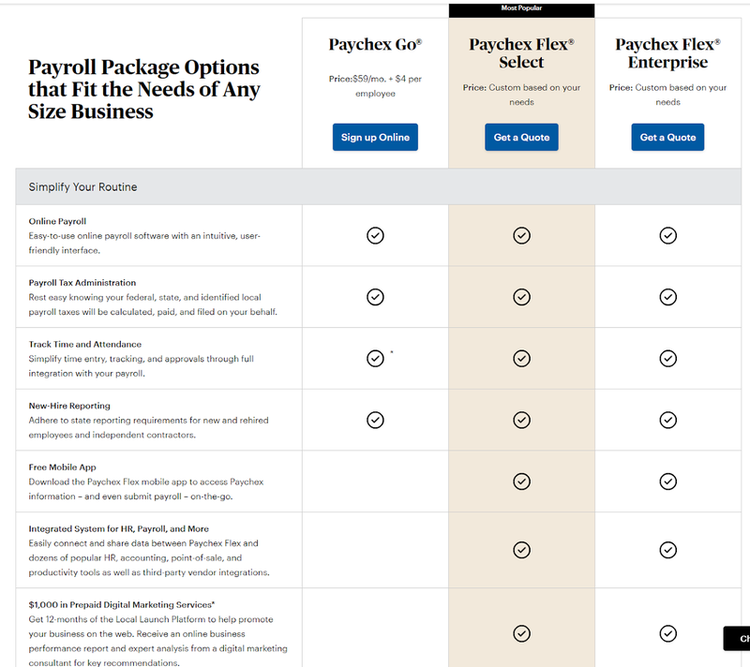

If you frequently run payroll on the go Paychex might be the best small-business payroll software for you. Payroll Time Attendance Benefits Insurance HR Services Support. Both ADP and Paychex offer entry-level DIY payroll services that scale up easily.

Paychex Vs Adp Vs Gusto Pricing Features What S Best

Integrate Time Tracking With Paychex Flex Ontheclock

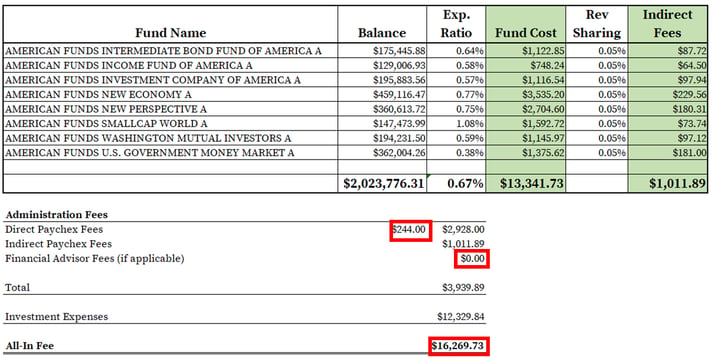

How To Find Calculate Paychex 401 K Fees

Paychex Pay On Demand Powered By Payactiv Payactiv

Payroll Costs For Ppp Reports From Gusto Paychex And Qbo What Numbers Do You Need Youtube

How To Efficiently Integrate With Paychex Buddy Punch

Paychex Flex Hr Software Review 2022 Businessnewsdaily Com

Paychex Flex Demos Paychex

Adp Vs Paychex Which Is Better For 2022

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paychex Flex Demos Paychex

Adp Vs Paychex Which Is Better For 2022

Paychex Flex Hr Software Review 2022 Businessnewsdaily Com

Paychex Flex Demos Paychex

Adp Vs Paychex Which Is Better For 2022

Paychex Flex Demos Paychex

Paychex Flex Demos Paychex